Coople is now offline from 1 Jan 2026. If you need support with existing shifts or any outstanding queries, please visit our help centre or get in touch. All outstanding Coople shifts will be paid and settled.Existing client login

Flexible work is a big trend, with companies increasingly relying on temporary, fixed-term, or selectively deployed skilled workers to stay competitive. Companies usually hire these workers as freelancers or via a digital staffing platform and workforce management solution like Coople, which employs its workers directly.

While both models offer flexibility, they have different legal and tax implications. Freelancers, platform-employed (or agency) workers, and hiring companies need to understand the differences between these working models to avoid potential risks and comply with the law.

Freelancers don’t have employee rights. For companies, it can be cheaper and easier to hire them. However, it is important to consider the risks associated with misclassifying workers and taking steps to protect employee rights, avoid potential penalties, negative PR, and ensure fair and legal working conditions.

The government defines who can be self-employed, because this working model can be used to avoid paying taxes. IR35 legislation, introduced by HMRC, was designed to determine whether a freelancer providing services to an organisation is genuinely self-employed or should instead be treated as an employee for tax purposes.

The responsibility for determining employment status under IR35 now sits primarily with businesses and public sector bodies, rather than with individual freelancers. This means hiring companies must carefully assess whether a contractor falls inside or outside IR35 rules.

Misclassification carries serious risks. Companies can become liable for backdated tax and National Insurance contributions, face heavy fines, and suffer reputational damage. For publicly listed companies, these consequences can even impact stock performance.

Because misclassification also leads to lost tax revenue, HMRC has made enforcement a priority and continues to increase scrutiny of businesses that rely on freelancers. Recent government updates have signalled tougher consequences for non-compliance and tax avoidance schemes, making it more important than ever for companies to ensure their workforce model is compliant.

To illustrate the risks, UK regulators continue to scrutinise companies that fail to uphold worker rights. For example, in 2023 the UK Supreme Court confirmed that Deliveroo riders are not entitled to collective bargaining rights, a case that highlighted how complex employment classifications in the gig economy remain.

High-profile legal battles like this, alongside earlier rulings such as the Uber drivers’ 2021 victory for minimum wage and holiday pay, demonstrate the reputational and financial risks businesses face when they misclassify workers or fail to meet statutory requirements.

The consequences can be severe. Companies found guilty of underpaying staff or breaching employment law not only face backdated costs and fines but also public backlash, falling investor confidence, and long-term damage to their employer brand.

Businesses that fail to pay at least the National Minimum Wage risk more than legal penalties — they also suffer from higher turnover, lower productivity, and reduced ability to attract talent.

Only 30% of companies are aware of employee and independent contractor misclassification risks. Using a digital workforce management platform like Coople can help businesses reduce these legal and reputational risks while ensuring that employee rights are protected.

Coople combines workforce management technology with access to a pool of flexible, directly employed workers. This means companies can quickly fill temporary or project-based roles without taking on the legal and compliance risks associated with freelancers. Workers benefit from a flexible schedule, guaranteed minimum wage, statutory protections such as holiday pay and pension contributions, and PAYE tax management—eliminating concerns about IR35 or misclassification.

By integrating workforce management tools with direct employment of flexible workers, Coople allows companies to plan, schedule, and manage their workforce efficiently while staying fully compliant. This dual approach ensures that businesses have both the talent they need and the legal and operational safeguards to scale safely.

Freelance jobs are on the rise. As of early 2025 (February to April), there were approximately 4.345 million self-employed workers in the UK - indicating a modest rebound since the pandemic dips. On top of that, side hustles continue to make a significant economic impact: collectively, they contribute around £70 billion to the UK economy annually.

From a legal and taxation point of view, freelancers are self-employed. They have the freedom to determine their own working hours and rates and can accept assignments from various clients. They enter contracts, negotiate and agree to terms, and complete the work accordingly. This is why freelancers are often referred to as independent contractors.

Typically, freelancers work independently without assistance from others to accomplish their tasks. Their ability to choose their own schedule and to work off-premisses also enables them to hold a regular job alongside their freelance work. It is common for freelancers to handle multiple projects simultaneously, allowing them to generate income from various sources. Unless otherwise specified in their contract, they can outsource their work to others.

In addition, freelancers are responsible for the success or failure (including fixing any unsatisfactory work in their own time) of their business and can make a loss or a profit.

In many situations, going freelance is the right choice – especially if someone prefers managing projects independently, negotiating their rates, and entering contracts with companies to provide their services.

While freelancing offers flexibility, it comes with certain responsibilities and drawbacks. One of these is the obligation to report income and pay taxes as a self-employed individual. Additionally, freelancers miss out on employee rights and benefits such as minimum wage, paid holiday, maternity / paternity leave, sick pay, and pension contributions.

Let’s take a closer look at these risks.

Being a freelancer means that individuals are responsible for paying the correct amount of tax and National Insurance (NI). This responsibility involves submitting annual returns and ensuring that sufficient funds are set aside throughout the year to cover these costs. The process can be quite demanding and costly, requiring the retention of contracts, receipts, and other important documentation. In many cases, it is necessary to hire a tax advisor to ensure that everything is done correctly.

By being self-employed workers forego their right to minimum wage. This is not an issue when workers are able to negotiate their individual rate or can directly influence their pay rate with their performance. In these situations, being able to set prices or make more money by working harder can be beneficial. However, when workers receive a fixed hourly pay or have less power to negotiate their prices, the situation can be different. In these situations, freelancing might make it easier to find work as it is cheaper for the client. However, if there is a choice, workers who perform hourly work at minimum wage level or just above are likely to be better off by being employed (directly or via an agency) as this means that their rights will be protected.

Lastly, being employed comes with a range of benefits that freelancers may not have access to, such as sick pay, maternity / paternity leave, holiday pay, pensions, and various other protections. It’s easy to overlook these advantages when everything is going smoothly, but it’s crucial to consider the long-term implications and seek out work opportunities that offer a safety net in case circumstances become more challenging. Planning ahead and securing employment that provides such protections can prove to be invaluable in the face of potential difficulties.

The trend towards flexible work continues to grow. Companies need solutions that allow them to respond quickly to changing workloads while meeting legal obligations and treating all workers fairly. Coople combines workforce management technology with a pool of directly employed flexible workers, providing compliance and peace of mind for both businesses and workers.

With Coople, companies gain access to specialised skills exactly when they’re needed, without committing to full-time hires. Flexible workers can be scheduled according to business demand, offering adaptability in working hours and project timelines. Workers, in turn, are guaranteed at least minimum wage, holiday pay, and other statutory protections.

Coople’s platform also simplifies the legal and operational side of flexible work. Payroll, taxes, and employment rights are managed directly through Coople, ensuring compliance and removing the risks associated with misclassification. This combination of technology, direct employment, and flexibility allows businesses to scale efficiently and confidently.

Ready to see how it works? Register for Coople today and watch a demo of our platform in action.

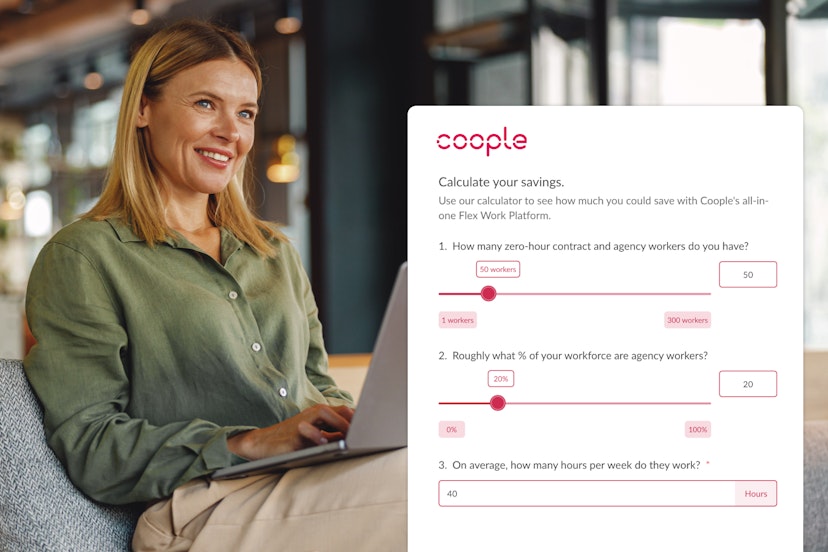

Coople’s staffing cost calculator shows what your flexible workforce is really costing you - not just in pay, but in planning time and hidden admin.

Optimise staffing with smart workforce management solutions that cut costs, boost productivity, and adapt to changing business demands.

Rota templates bring structure, but they can’t solve all challenges. See how to build a scalable workforce strategy beyond the template.